LAB is a leading international RegTech that transforms the customer journey through user-friendly digital workflow solutions. Our technology accelerates complex customer onboarding and automates AML, KYC, KYB verification and PEP/Sanctions screening for all types of entities using an easy-to-integrate API solution.

Harnessing invaluable insights from over 100 esteemed regulated entities around the globe, LAB simplifies account creation and streamlines customer lifecycle management, including remediation and ongoing customer due diligence processes.

Benefits

LAB’s innovative onboarding and compliance platform solves the key governance, risk and compliance challenges that regulated entities face today. LAB has continuously evolved and innovated over the past 12+ years to deliver significant advantages to our clients.

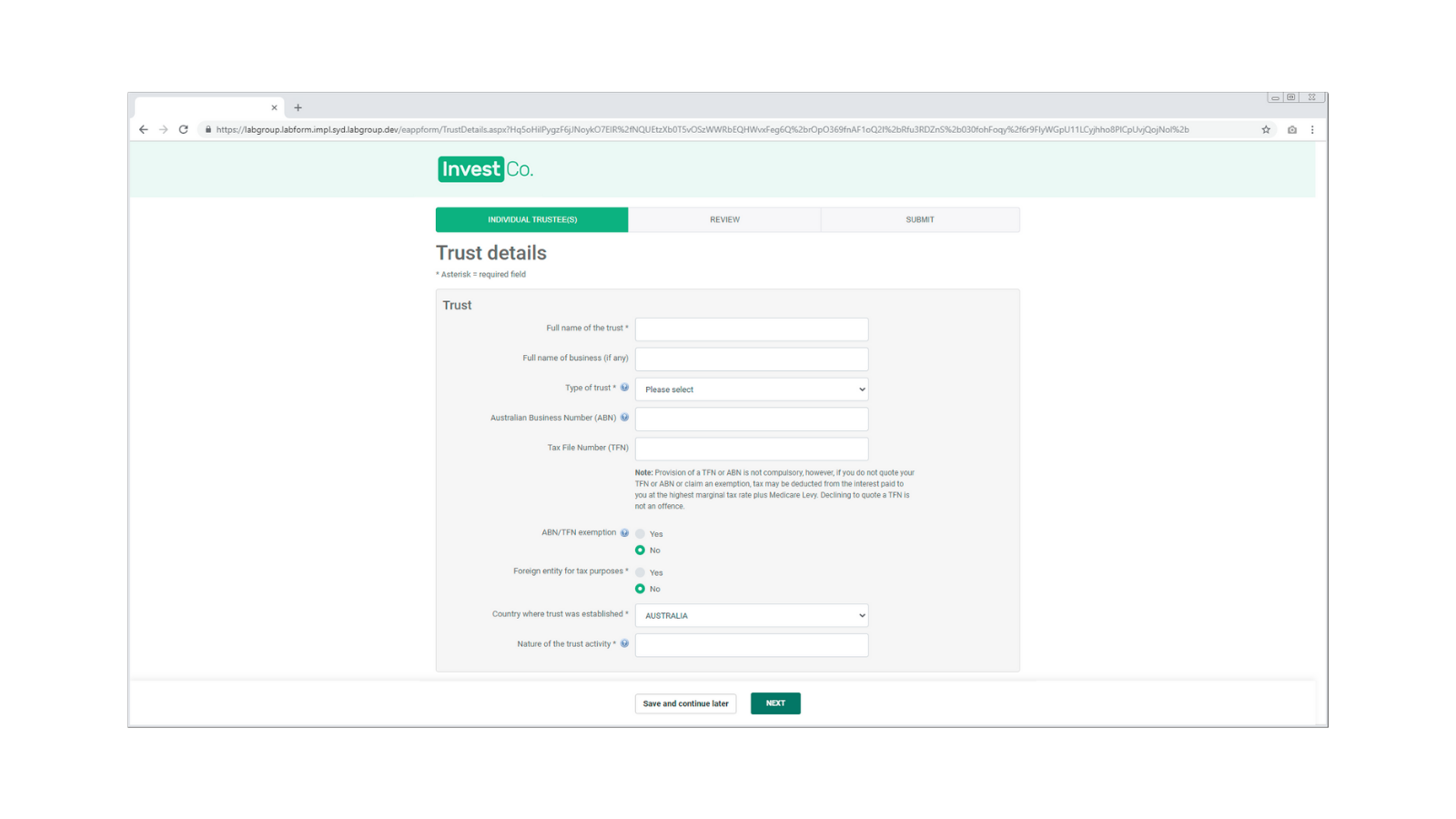

Dynamic Onboarding Framework

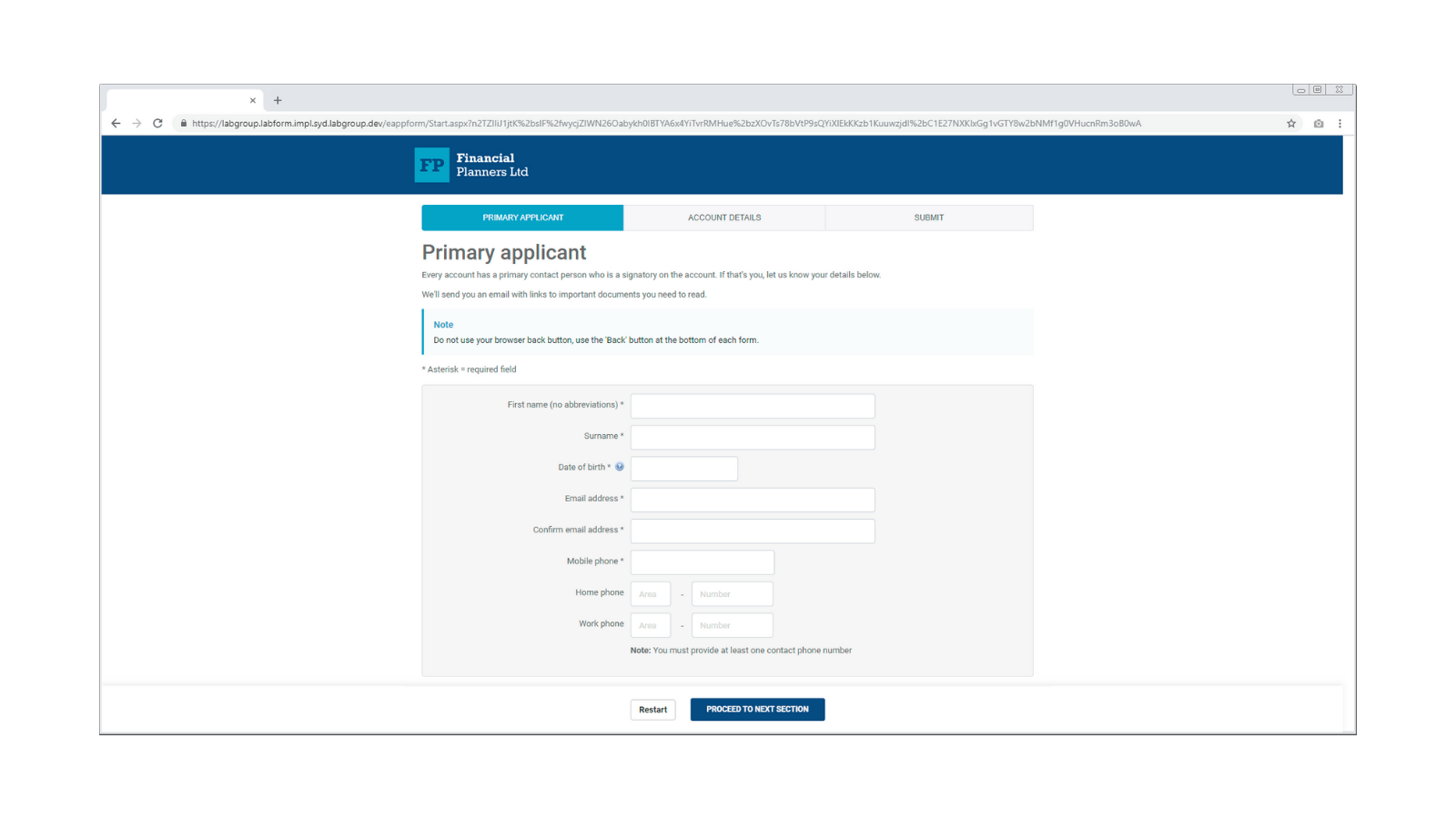

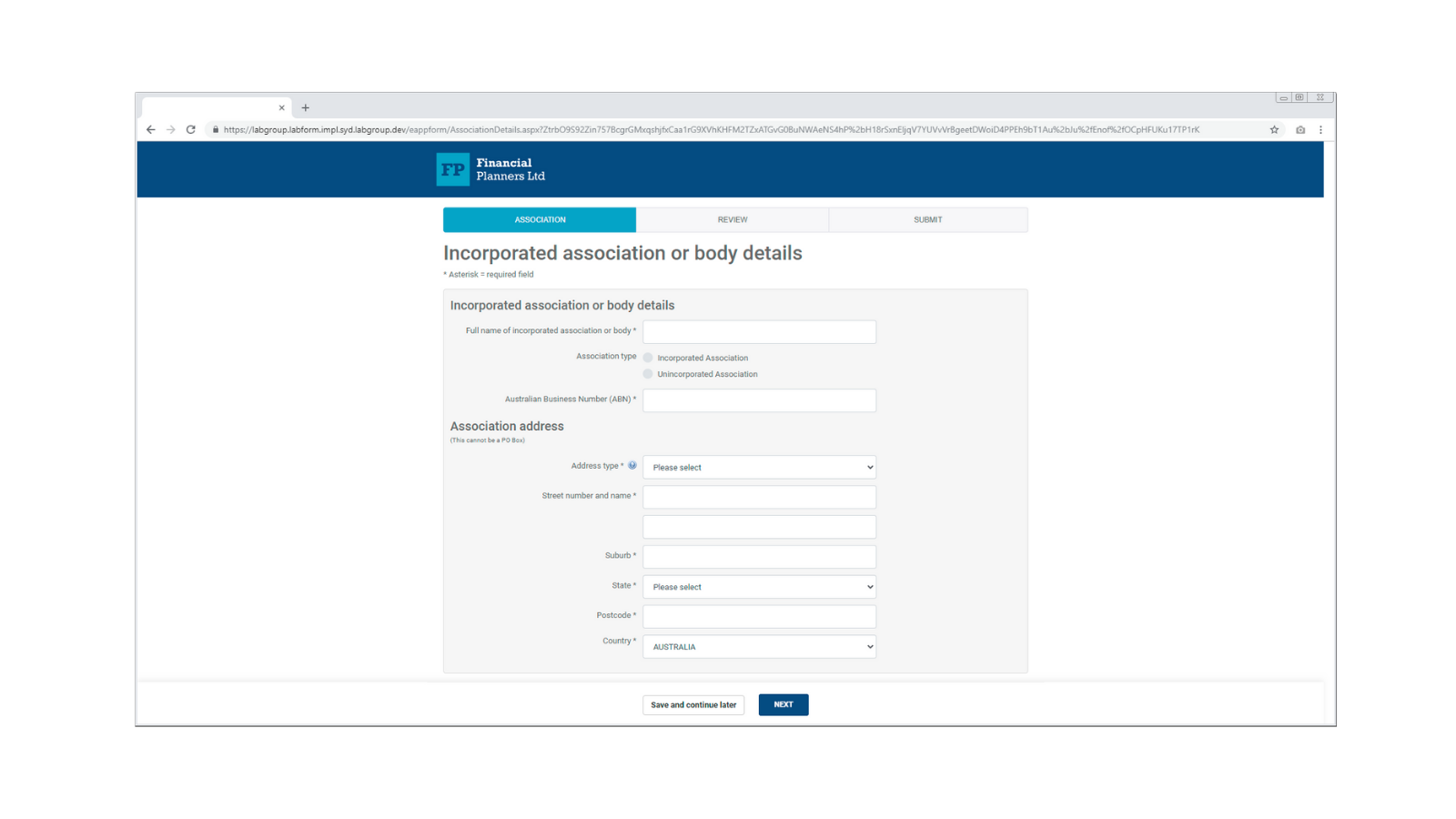

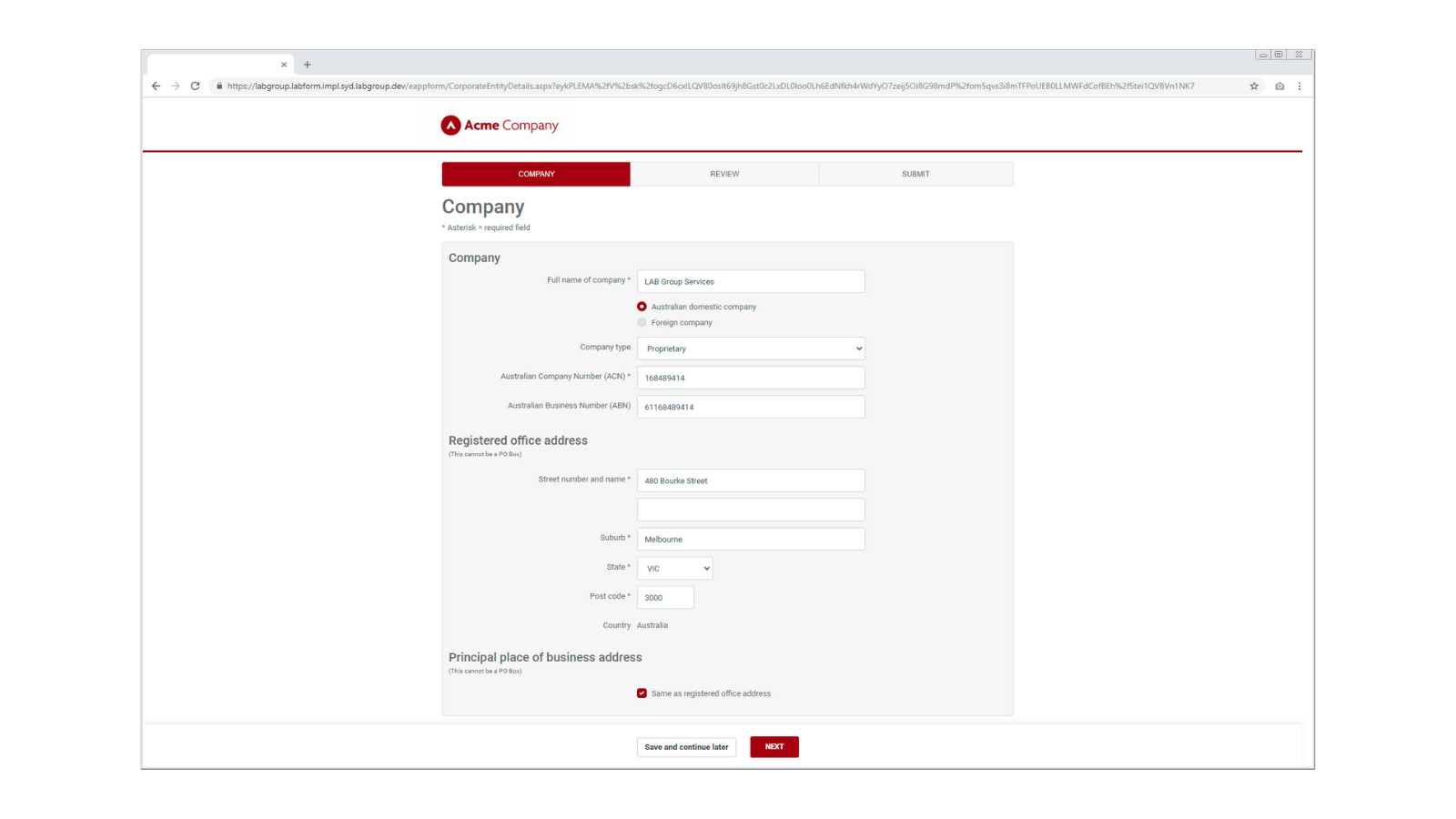

LAB’s dynamic onboarding framework digitises even the most complex application processes and supports all entity types recognised under the Anti Money Laundering/Counter-Terrorism Financing legislation. Our user friendly, multi-lingual framework supports all application types including complex applications across borders, jurisdictions, and multiple products, providing an innovative digital signature process to streamline customer acquisition.

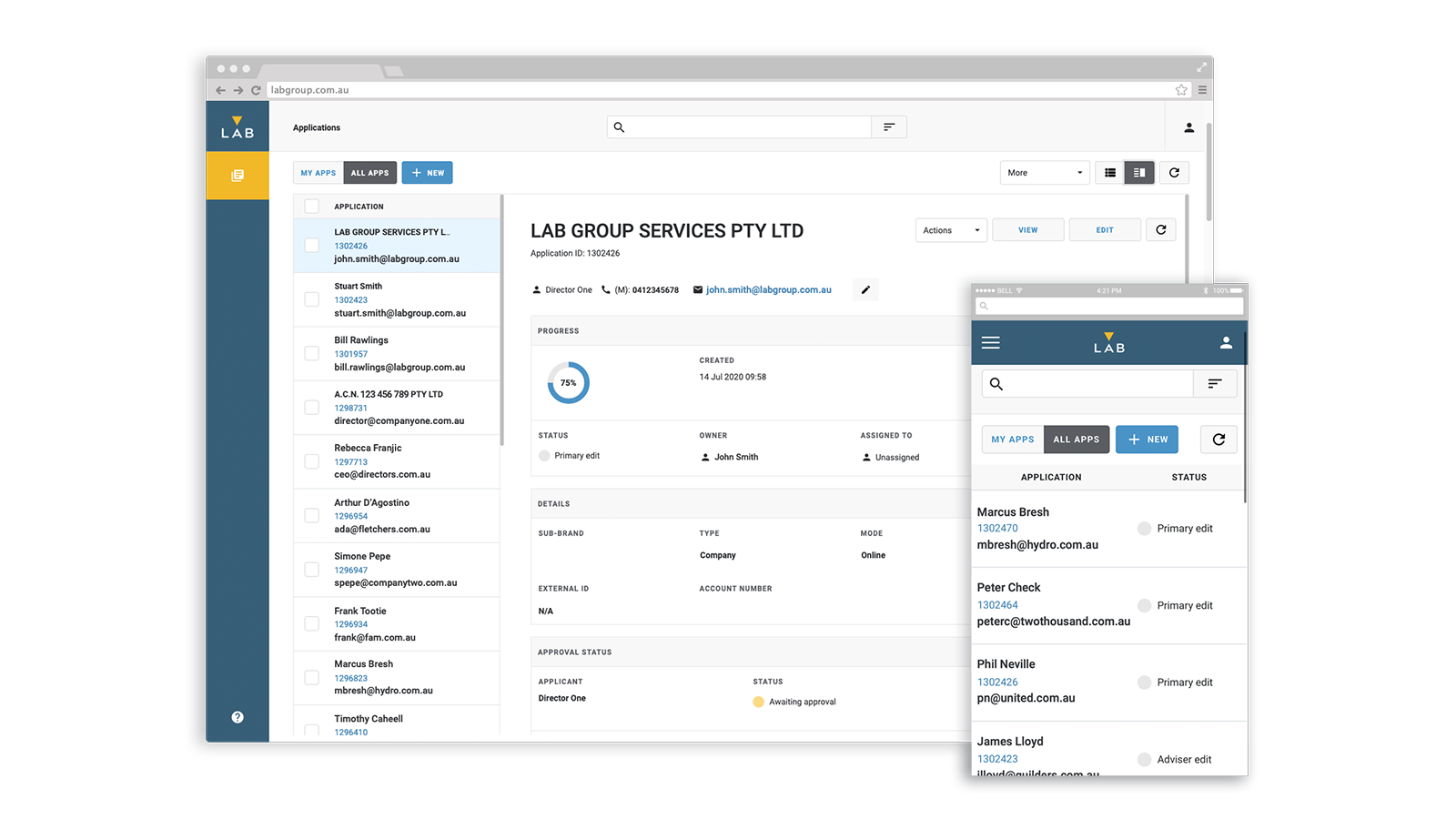

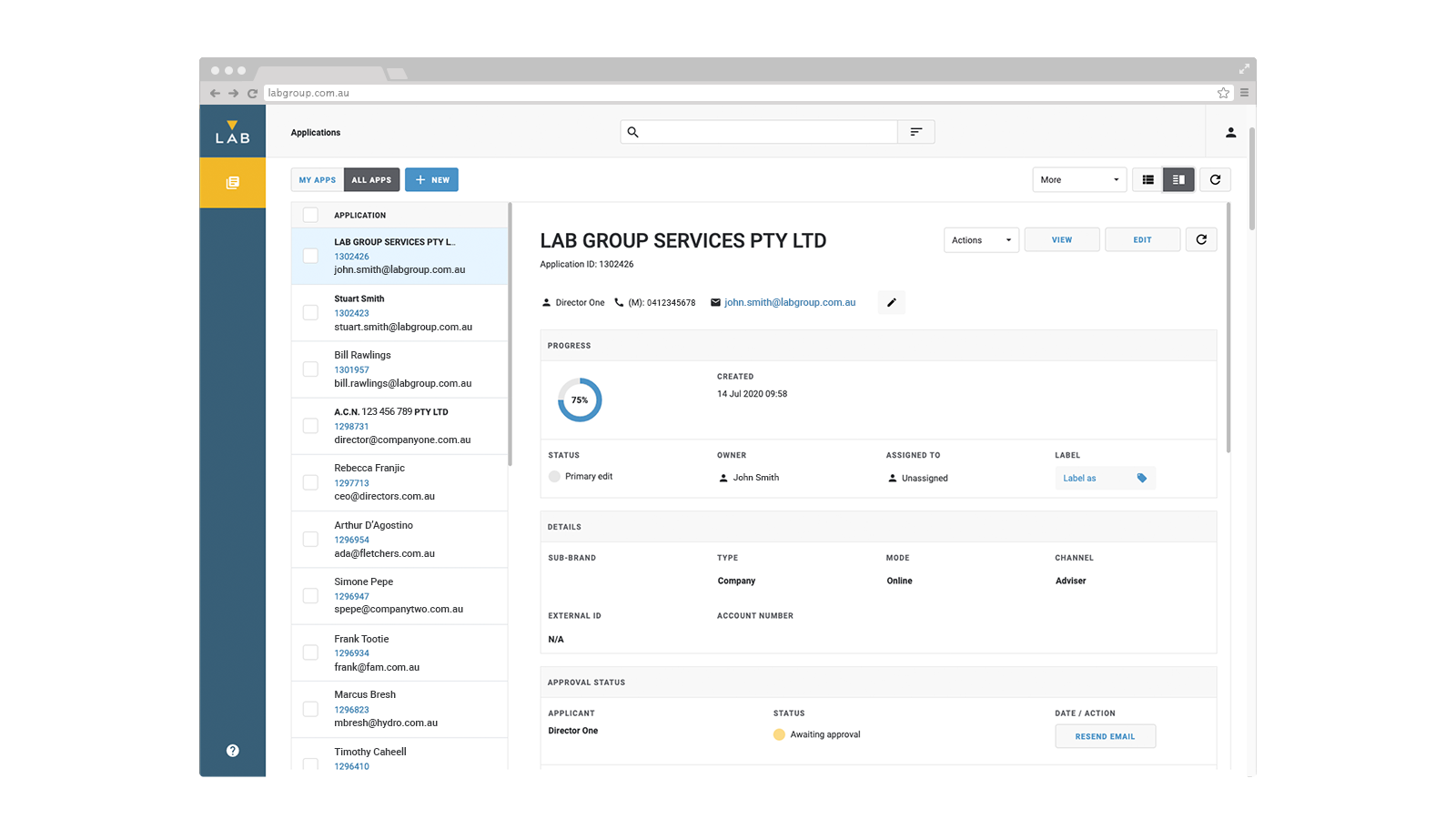

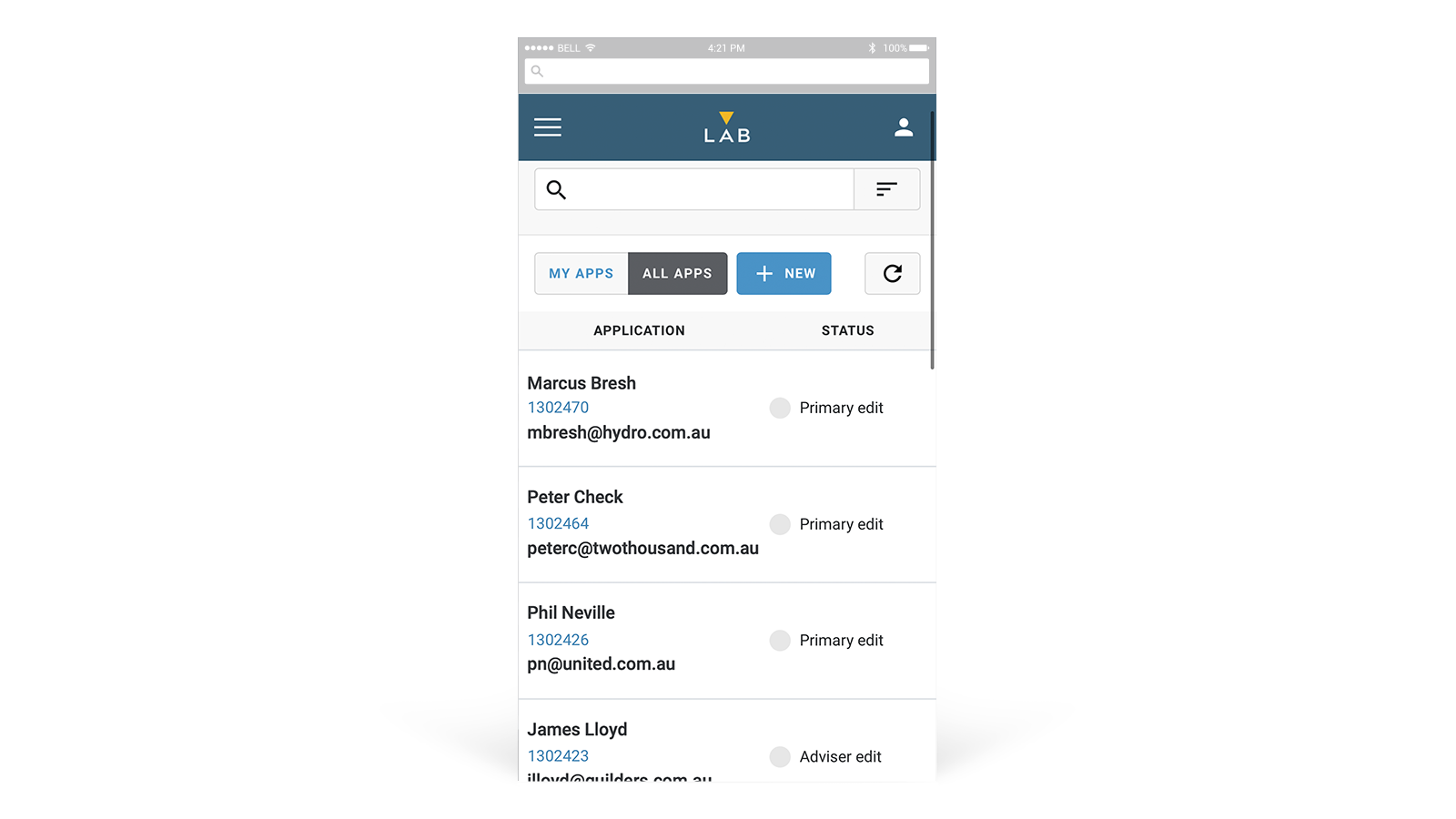

LAB Application Manager

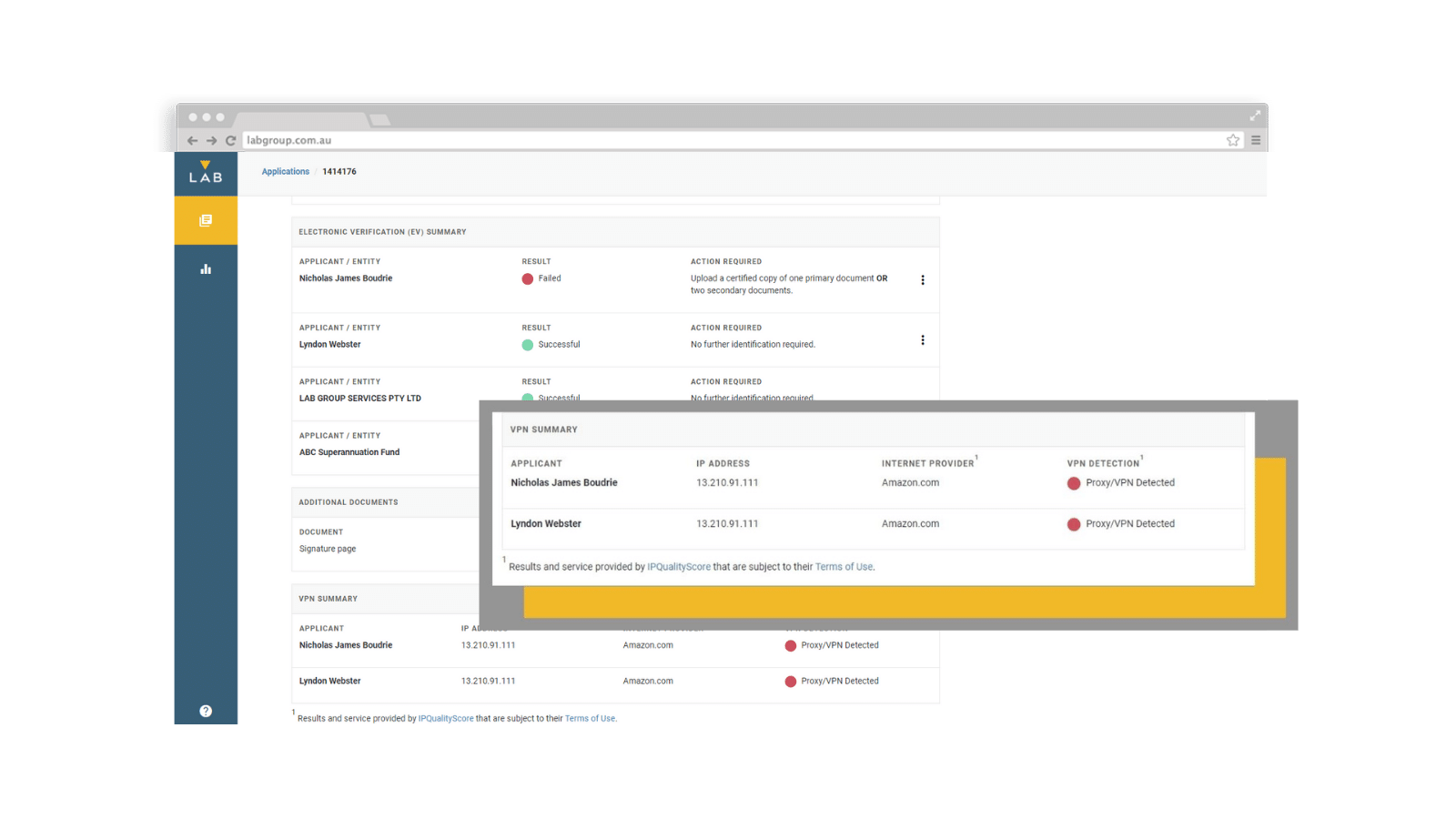

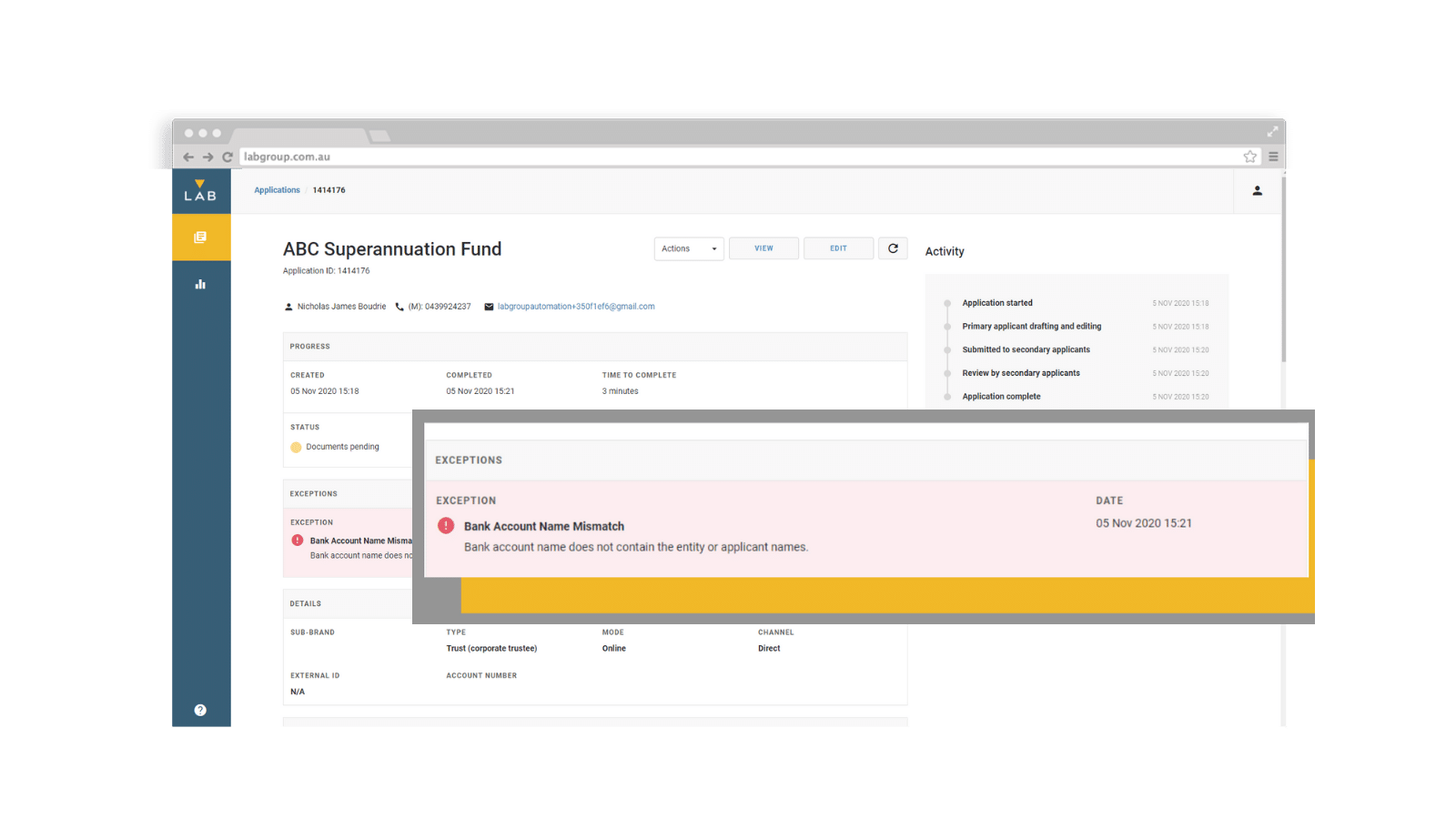

Not only does the LAB Platform assist with acquiring new business and performing identity verification, LAB’s Application Manager assists with managing your customers and administering applications. Additionally, you will be able to follow up leads with automated email reminder functionality, manage workflows and monitor the progress of applications from beginning to end. It also reduces time spent in chasing identification documents and accelerates the customer onboarding process.

Our Solutions

LAB Platform

The LAB Platform is an end-to-end account opening and digital workflow management platform. Our technology orchestrates digital workflow solutions for different use cases to improve the customer journey and accelerate complex customer onboarding and the secure verification of core customer information.

LAB Verify

LAB Verify is an easy-to-integrate verification solution for all entity types that reduces onboarding time, costs, and the risk of regulatory fines. LAB Verify accelerates customer verification directly into your digital onboarding journey validating AML, KYC, KYB, & PEP Sanctions for all entity types through an API solution.

LAB Network

The LAB Network delivers unprecedented connectivity across products and jurisdictions to accelerate customer registration, reduce onboarding time, increase security, and achieve higher completion rates. The LAB Network enables the seamless consented movement of consumer profile data, offering consumers an efficient onboarding experience into multiple providers across the financial services market.

Working with LAB Group

With over $60bil invested through LAB during 2022, LAB has been successfully used across a number of areas of financial services including Banking, Stockbrokers, Superannuation and Pension Funds, Wealth Asset Management, Financial Advisers, Business and Property Lenders and Margin Foreign Exchange services and we have developed technology to simplify complex KYC processes and reduce fraud, legal and compliance risk.

1. Speak to Our Team

Enquire with our team to learn how our technology expands operational effectiveness, minimising administration costs and increasing application completion rates.

2. Product Demonstration

View a product demonstration showing how LAB Group can deliver a digital, connected experience for your customers and bring your digital acquisition process to life.

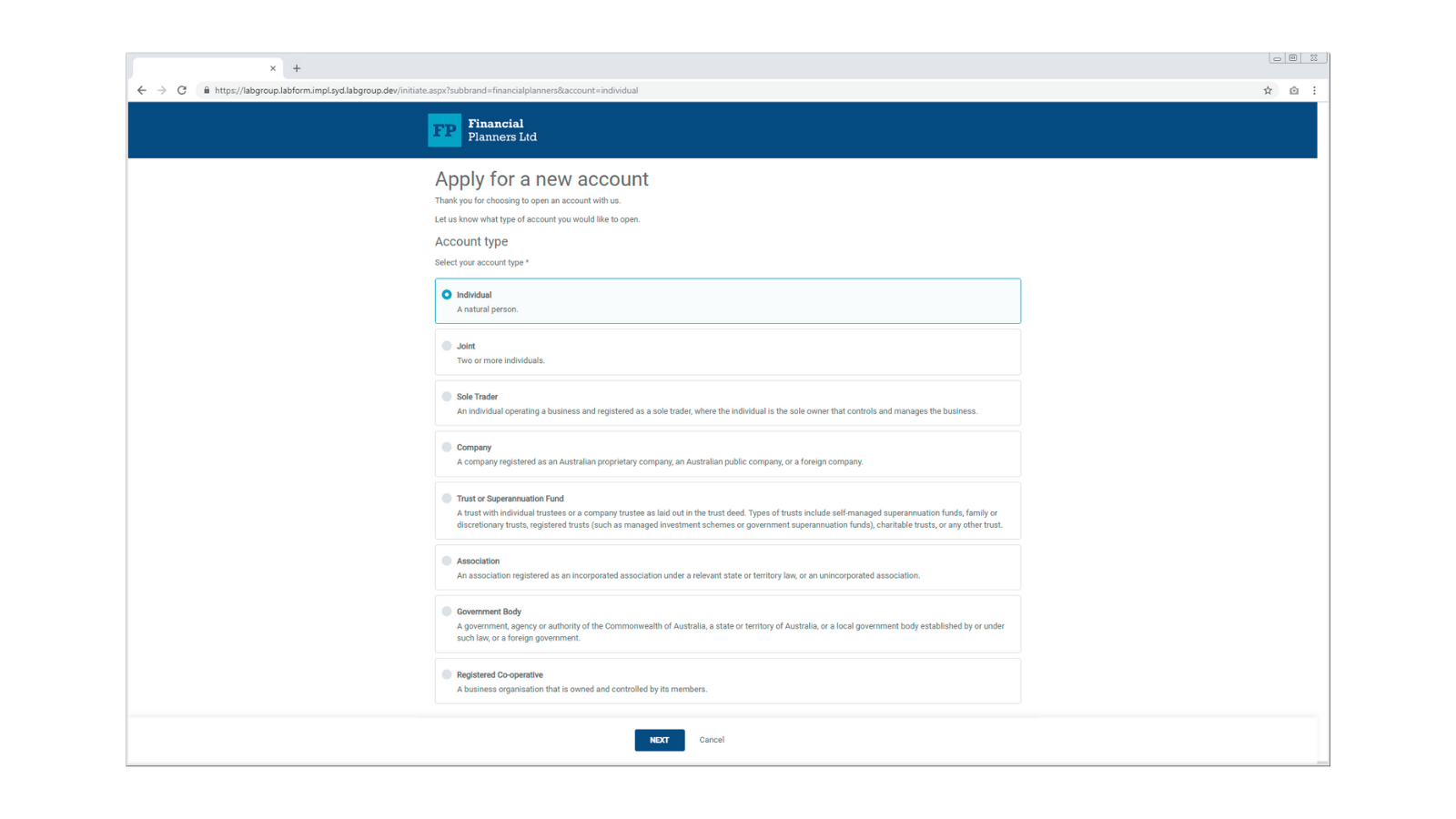

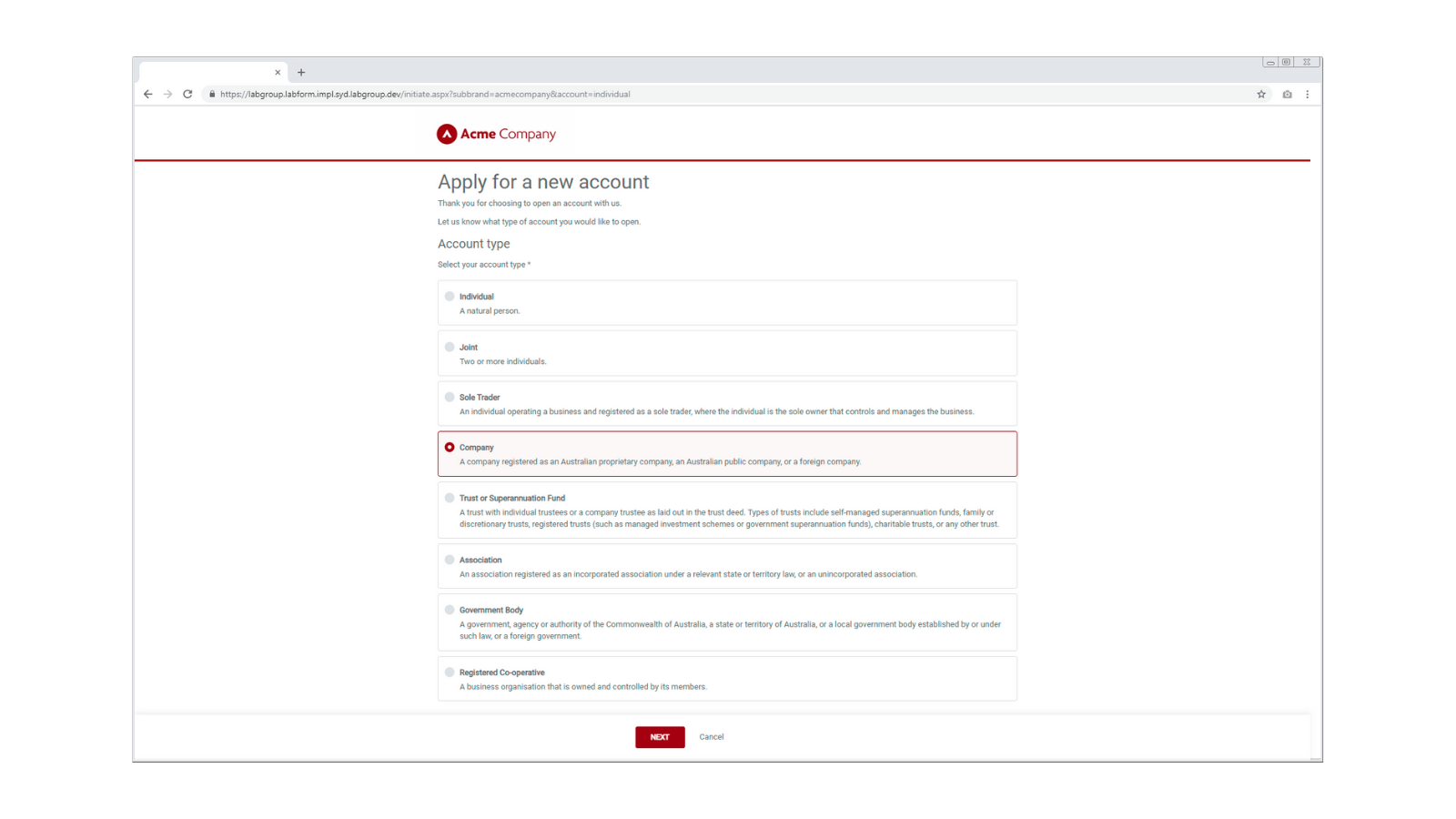

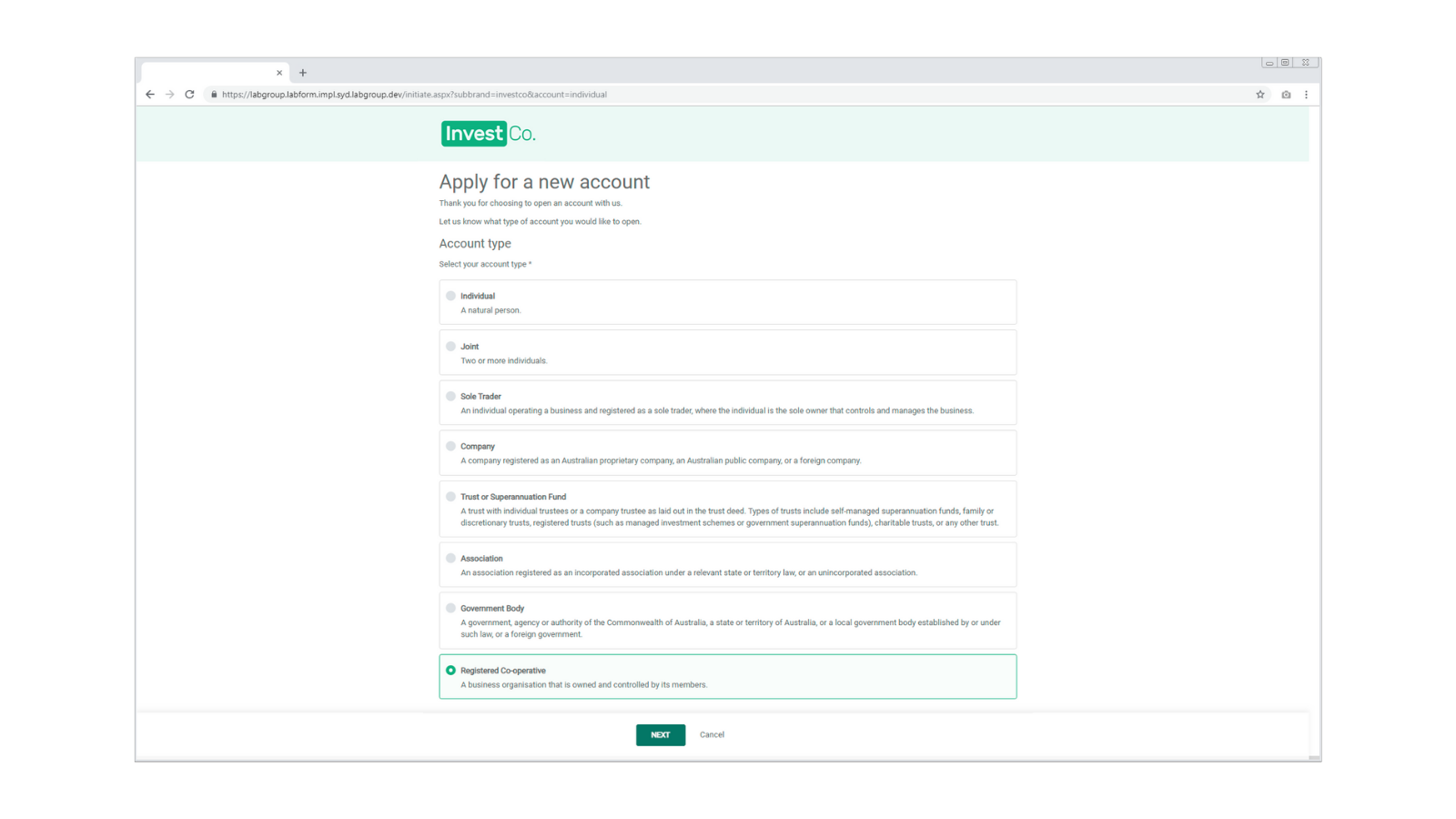

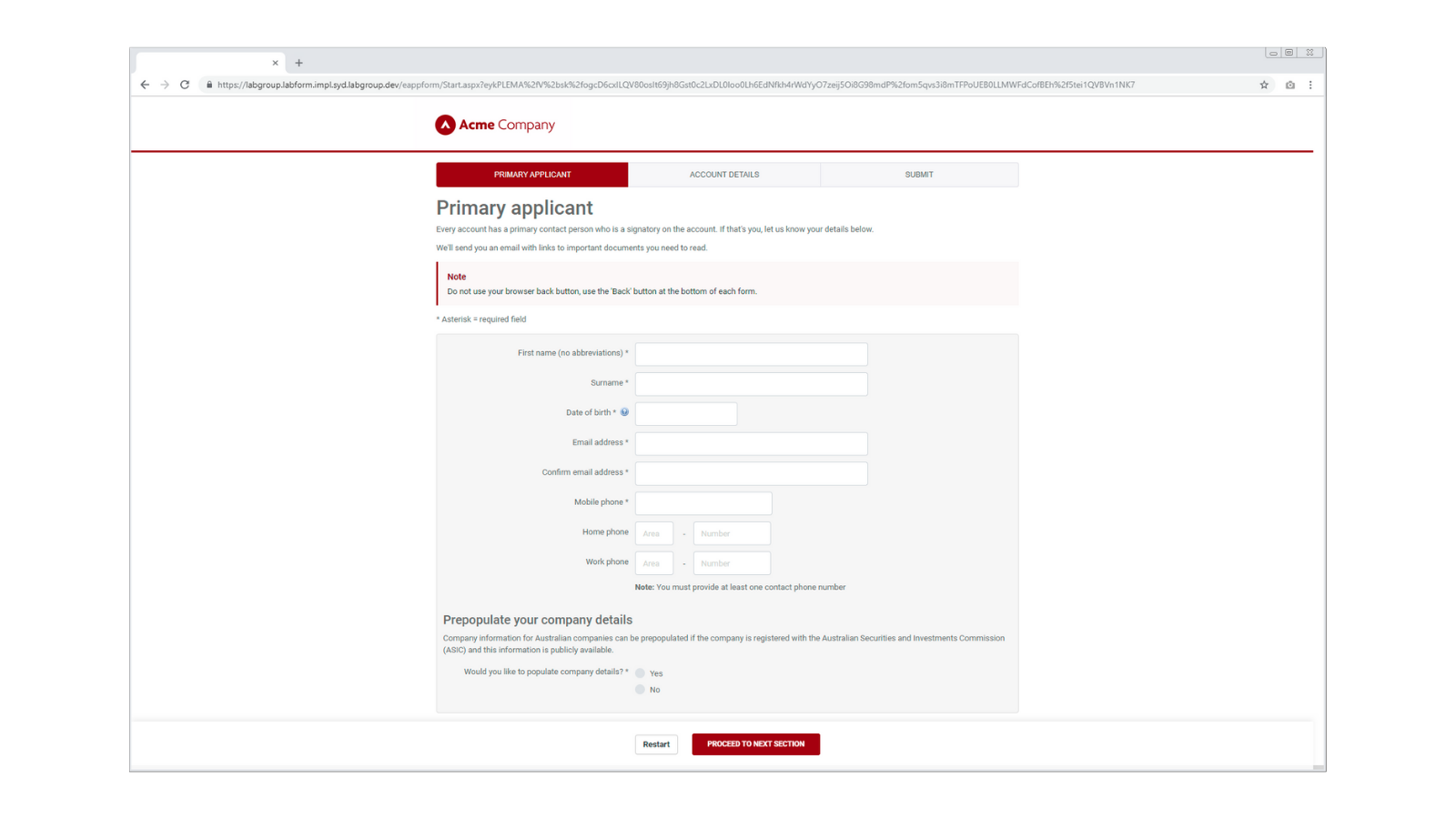

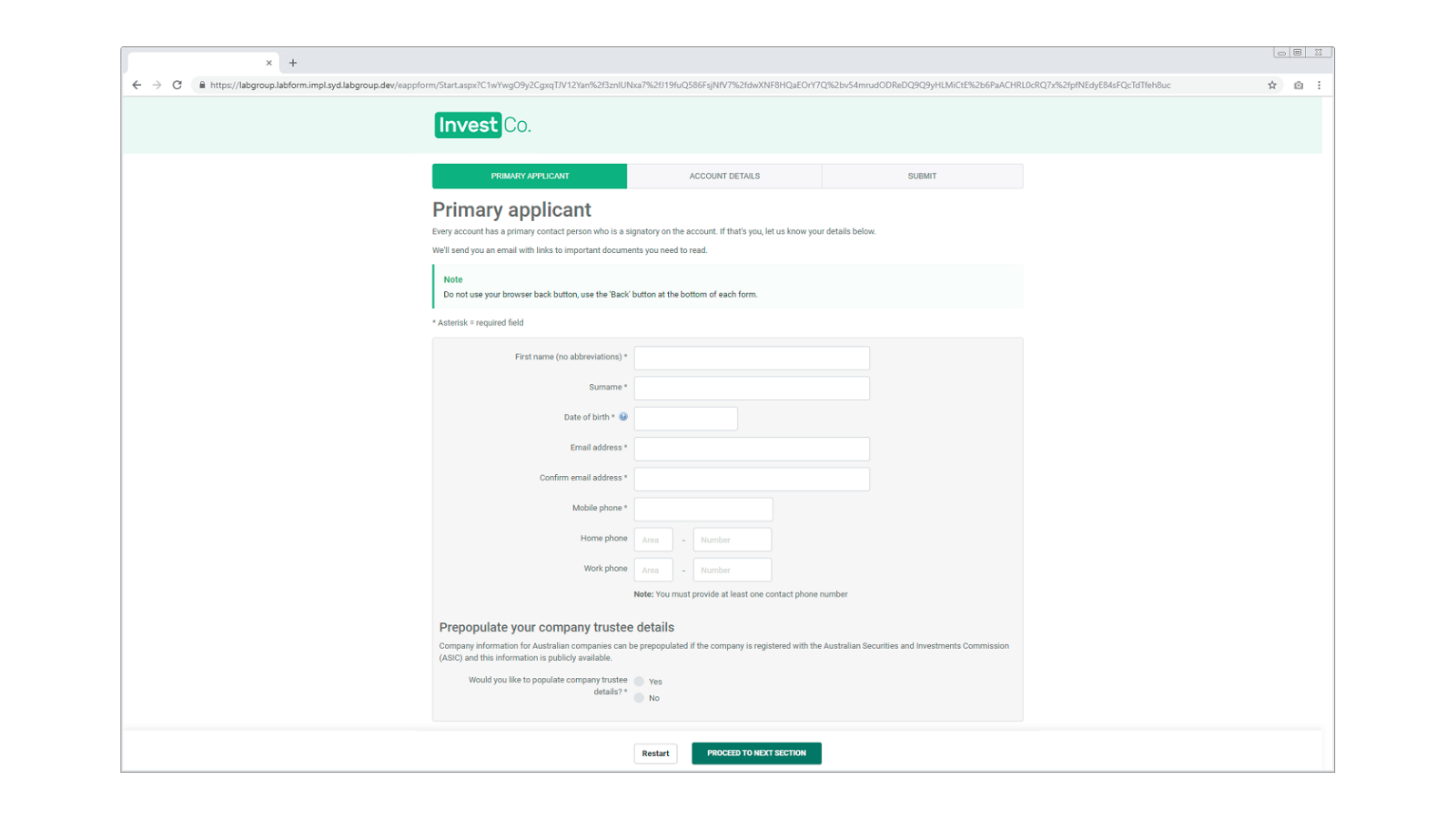

3. Customisable Branding

Configure our customisable features that include font and branding styles to integrate with your digital assets creating a seamless customer journey from your website to application completion and onboarding.

4. Community Access

Access the LAB Community for self service, thought leadership and other resources.

5. Technology Support

Our Help Desk provides technology support for ongoing improvement.

6. Compliance Monitoring

As a unified SaaS platform, our technology is continuously updated to remain compliant and relevant with industry trends and customer engagement methods.

7. Product Updates

Get access to updates, new features and continuous improvement with monitoring of advanced analytics and data analysis.