Streamline customer onboarding and ongoing engagement through a multi-channel, white-labelled instance

From initial onboarding to ongoing lifecycle management to adviser registration, LAB provides secure and fully integrated tools for compliance, customer and adviser management.

Configurable framework to capture KYC data

LAB combines innovative technology with comprehensive financial services experience to improve all aspects of client lifecycle management, which empowers institutions, corporates and SMEs

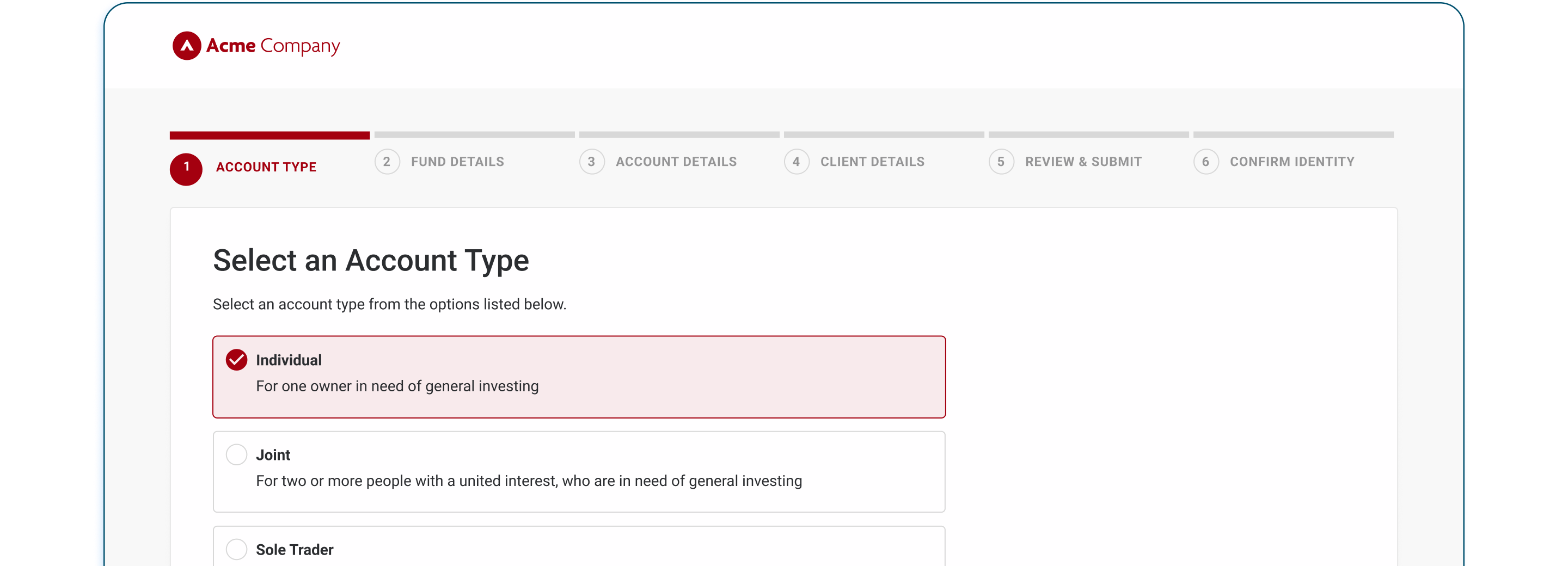

Digital Onboarding

LAB Engage transforms complex onboarding into a streamlined digital experience. Intelligent workflows adapt to customer entity type - from individual investor, family trust, or institutional entity - automatically collecting the right information at the right time. White-label the entire experience with your brand while the platform handles regulatory complexity behind the scenes. Eliminate paper forms and manual data entry. Configure workflows to match your risk appetite and business processes, with built-in escalation paths for case management.

Automated KYC/AML Data Capture

Automate KYC/AML data collection across multiple regulatory frameworks, including AUSTRAC, FATF, and jurisdiction-specific requirements. The platform adapts to entity type and ownership structure, prompting customers for the right information at the right time. Navigate complex beneficial ownership automatically, reducing manual follow-up while maintaining compliance across every market where you operate.

Risk Based Customer Due Diligence

Apply appropriate due diligence based on customer risk profile. LAB Engage automatically triggers enhanced checks for higher-risk customers while streamlining processes for standard retail investors. Customer due diligence orchestration adapts to customer type, product complexity, transaction thresholds, and risk indicators. Integration with LAB Verify provides access to verification services across jurisdictions, from document checks and biometric authentication to PEP/sanctions screening and adverse media searches.

Integration Orchestration

LAB Engage connects your onboarding process with your broader technology ecosystem. Purpose-built integrations with leading fund administrators, registries, and wealth management platforms eliminate manual data re-entry. Once a customer completes onboarding, verified data can flow automatically to your down stream systems in the correct format. LAB Engage integrates with back office systems, registry platforms, CRM systems, compliance platforms, and document management systems.

Multi-Channel Onboarding

Meet customers where they are. LAB Engage supports adviser-assisted onboarding, direct-to-customer digital journeys, and hybrid approaches that work alongside traditional paper-based processes. Customers can start on their desktop and finish on their mobile (or vice versa), pause and resume as needed, or have advisers initiate applications on their behalf. Customers simply confirm details and digitally accept documents like PDS, T&Cs, and consent forms. For advisers who prefer traditional approaches, LAB Engage supports print-sign-upload workflows. Advisers remain in control of the customer moment while firms capture all data digitally for operational efficiency.

Branded Client Experience

Deliver onboarding under your brand, not ours. LAB Engage applies your visual identity, terminology, and tone throughout the customer journey. Configure welcome messages, email templates, and interface elements to match your brand guidelines. Every interaction reinforces your firm's identity while you benefit from enterprise-grade compliance infrastructure. White-labeling ensures your brand equity remains front and center.

Onboard customers faster while meeting global compliance requirements

Automate KYC/AML data collection, identity verification, and risk-based due diligence across jurisdictions. Handle everything from retail investors to complex institutional entities with multi-level ownership structures—all while delivering a seamless digital experience.

Complex Entity Onboarding

Captures structured data for companies, trusts and associations with tailored onboarding steps.

Pre-Built Financial Services Integrations

Provides ready-made connections into key financial platforms for smoother operations.

Dynamic Form Logic

Adjusts form fields automatically based on entity type and jurisdiction to collect relevant information.

Multi-Channel Support

Delivers onboarding across direct and advised channels with white-label and platform configurations.

Multi-Party Consent and Approval Routing

Coordinates approvals across multiple stakeholders with clear tracking and consolidated decisions.

Multi-Language & Multi-Jurisdiction Support

Presents interfaces in multiple languages and adapts requirements to meet jurisdiction-specific regulations.

The RegTech Leader in Lifecycle Management and Digital Onboarding

LAB Group is a leading Australian regulatory technology (RegTech) company transforming customer lifecycle management, compliance automation, and digital onboarding for regulated businesses. Founded in 2010 and headquartered in Melbourne, LAB Group serves a global client base across APAC, the UK, and Europe, with deep penetration in the financial services sector. LAB has successfully facilitated over 2 million consumer engagements across 15+ verticals including asset management, banking, wealth, stockbroking, superannuation, and professional services.

Transform your customer journey with LAB Group.

Join leading institutions that have modernised their compliance infrastructure and elevated their customer experience. Schedule a demo with our team to explore how LAB Group can transform your operations.